In this comprehensive Plus500 Review we would cover all the information you need to know completely about this crypto broker. Plus500 is regarded as a pioneer in the field of cryptocurrencies. This is primarily because the provider was one of the first to offer CFDs on Bitcoins. It offers a wide range of instruments that no other competitor offers to date. In total, more than 2000 underlying assets can be traded on the broker’s portal. In principle, the provider’s offer is relatively generous, but no special account types are offered. Furthermore, the broker does not provide any training materials.

In addition, customers are provided with a free demo account. The following test deals with Broker Plus500 and highlights the different aspects of the provider.

Plus500 in portrait: Many crypto currency CFDs tradable

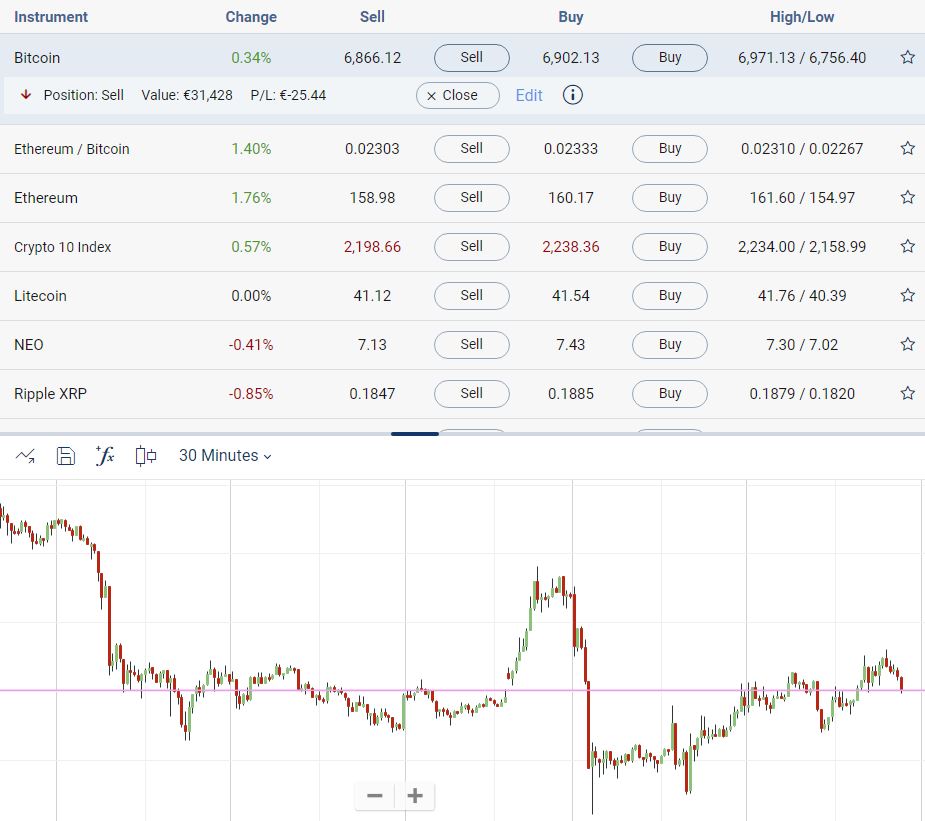

For almost two and a half years now, everything at Broker Plus500 has been revolving around digital currencies. The provider Plus500, however, already dealt with crypto currencies before the trend. Customers could already find some currencies in the offer at that time. Already since 2013 investors can trade the Bitcoin CFD. Since then, Plus500 has regularly expanded its offer. The following digital currencies are currently available:

Plus500 provides a wide range of digital currencies in the Crypto Broker comparison. In addition, the broker offers not only the most popular and well-known currencies, but also crypto currencies that have only recently become popular.

At Plus500, digital currencies can be traded via CFDs. Those who wish to trade in this way do not receive currency units, but primarily participate in the price development. The maximum leverage for Bitcoin is up to 1:2.

Regulation and Customer Protection

The issues of regulation and deposit protection play an important role in the area of security and seriousness, which brings us to the question: Is Plus500 reputable? Many new customers ask themselves this question. However, it can be answered easily and quickly. Basically, Plus500 is a safe and reputable provider because of official regulation.

Regulated i.e. in Cyprus and UK

The Plus500 UK Ltd. division keeps client funds in a variety of accounts. This ensures that the company capital and client capital are not mixed up. This means that only client capital is used for market speculation. Plus500UK Ltd is authorised and regulated by the Financial Conduct Authority, FRN 509909 and registered as company in England and Wales (Company No 07024970) specialising in Contracts for Difference (CFDs) in commodities, shares, currencies and indices. The Plus500 CY division is regulated by the Cyprus Financial Supervisory Authority.

Client funds are managed separately

Broker Plus500 is also a member of the Financial Services Compensation Scheme. The Financial Services Compensation Scheme (FSCS) is the UK’s compensation fund of last resort for customers of authorized financial services firms. If a firm becomes insolvent or ceases trading, the FSCS may be able to pay compensation to its customers. The FSCS covers business conducted by firms authorized by the FCA. Clients of Plus500UK Ltd would fall under the ‘investments’ claim category, whereby the cover is £85,000 per person per firm. If a client held an account with an authorized investment firm and there was a shortfall in segregation, they might still receive up to £85,000 in compensation.

What are the opportunities and risks?

This provider does not have an obligation to make additional contributions, which is why customers only invest as much money as they have ultimately deposited in the trading account. The fact that security is of great importance to this provider can be seen from the way the customer data is handled. All transactions are carried out using high-quality SSL encryption, so that unauthorised third parties cannot access this data.

Security plays a major role at Plus500. The provider takes many measures to offer its customers the most comprehensive protection possible. Our Plus500 crypto experience shows that the provider is regulated by the Cyprus Financial Services Authority. In addition, customer data is secured using high quality SSL encryption.

The conditions

Free Demo account

The demo account amount is €40.000,00 . Once the balance of the demo account drops to €200 (or the equivalent currency amount) or below, the initial demo amount will be automatically reinstated by the system

Particularly advantageous is the unlimited use. This allows each customer to take enough time to learn how to trade. Moreover, such a demo account is not only necessary for new customers, because existing customers can also use it to test new strategies or analysis methods.

The demo account is a great help for beginners and should always be used at the beginning. Digital foreign exchange usually has low liquidity, so it is associated with high volatility. In addition, the price of digital foreign exchange can be strongly influenced by the press. An investor must therefore adapt immediately to new circumstances to ensure a successful trade.

The demo account provided is an interesting training opportunity for professional traders, as strategies can be tested without any risk. After all, trading with crypto currencies is associated with a high risk. This risk often results in large losses. To be successful, even experienced traders should regularly train and expand their skills with a demo account.

Illustrative prices

Real money account: One real money account

Basically the provider Plus500 has a small number of accounts. There are two types of accounts: A demo account and a real money account. This system is primarily advantageous for traders who trade with small amounts of money. Investors who are willing to trade with more capital may see a disadvantage in this system. In general, providers offer better conditions for frequent traders, but this is not the case with Plus500. The single account system provides simplicity and clarity. Because it is clear to every investor which services and features are offered. In addition, all conditions are clearly communicated, as there are no costs and fees for different accounts.

Our experience with Plus500 shows that the provider has two types of accounts. Firstly, customers can use a demo account and secondly, a real money account. In the demo account, customers trade virtual money for practice purposes. The real money account is available for all users who wish to trade with real money.

Account opening: quick and easy in various currencies

Users can access the Plus500 website through a variety of channels. Plus500 can be opened via Webtrader, Windows Phone App, iOS App and Android App. Registration for a demo account with Plus500 is usually completed within a few minutes. However, the registration process for a real trading account requires customers to verify their identity and residency address. A copy of the identity card and a consumer invoice are required for this. Further several documents and a questionnaire to be read. Once the registration process for real trading account completed, customers can use both – the demo account and the real account. Plus500 does not offer its services to US citizens.

Payments: Sufficient means of payment available

Plus500 is much better positioned in the payments area. There are enough payment providers here. If you want to deposit money, you must first go to the personal account settings. There you will find the sub-item “Capital management”. In this menu you can select the sub-option “Deposits”. There you have to enter information into the fields. The classic bank transfer and the credit card are available as payment options. Electronic purses such as PayPal and Skrill can also be used for payments.

Important: Withdrawals are made using the same payment method that was selected by the user when making the deposit.

The Plus500 test shows that some payment options can be used. Classic payment options such as bank transfer and credit card can be used. Electronic purses such as Skrill and Neteller are also available. Withdrawals are transferred via the same payment method as deposits.

Plus500 Review Conclusion: Well-positioned crypto broker with a broad and diverse crypto-offer

Our Plus500 Review shows that the provider is an experienced crypto broker in digital currencies. Plus500 is also one of the pioneers in this field, as Bitcoin CFDs have been traded here since 2013. Since then, the offering has been steadily expanded. Plus500 now offers a wide range of cryptocurrency CFDs, both well-known and less well-known. These are popular with many customers. Every new customer receives free access to a demo account, which is offered for learning how to trade. Plus500 offers a Trader’s Guide where there are How-To videos, to learn and understand how to use the Plus500 platform. Payments can be made easily and quickly as there are enough payment options available. At Plus500 there are two different account types, so there is no confusion about conditions and services. Customer service can be contacted on weekdays via email and live chat. Furthermore, the user can access the Plus500 offer through an application. The apps can be found in the respective App Stores.

Disclaimer All content on our website is for information purposes only and does not constitute a recommendation to buy or sell. This applies to assets as well as products, services and other investments. The opinions expressed on this site do not constitute investment advice and independent financial advice should be sought whenever possible. This website is not intended for use in jurisdictions where the trading or investment described is prohibited and should only be used by persons and in a manner permitted by law. Your investment may not be eligible for investor protection in your country or country of residence. You should therefore carry out your own due diligence. This website is available to you free of charge, but we may receive commissions from the companies we offer on this website. |

Sharing is caring, right?